Indian Overseas Bank Share Price Target 2025, 2026, 2027, 2028, 2029, 2030 to 3035

If you think about Indian Overseas Bank (IOB) share will be profitable for investing in recent times, you should know about Shree Indian Overseas Bank share price target. Today in our blog we will explore the valuable facts about Indian Overseas Bank share Price Targets for 2025, 2026,2027,2028,2029, 2030 to 2035. We did a research and took valuable advices from experts to make this blog about the stock’s future target, financial strengthen, growth potential and recent financial performance etc.

Overviews of Indian Overseas Bank Share

- Indian Overseas Bank(IOB) is an Indian public bank based in Chennai. IOB was established in 1937 by Chidambaram Chettyar. It was one of the largest banks that were nationalist in 1969.The promoter of IOB is The Government of India.

- IOB has about 3,220 domestic branches, 3500 ATMs, 2 Digital Banking Units (DBU), 2,250 business correspondents across all over India and 4 foreign branches, one each in Colombo , Hong Kong, Singapore, Bangkok.

- The bank has shown 2.55kCr. as its revenue (corporate/Wholesale banking: 38% , retail banking : 36%, Treasury : 24% and other : 2%).

- The branches of IOB are extended over the countries (Semi-Urban: 30%, Rural:28%, Metro: 22%, Urban:20%.

- The bank has provided loan in different sectors (Agro: 29%, Retail:24%, MSME:20%, Corporate/other:27%).

- It has opened 22 specialized SME branches over all over India.

- The bank has owns an 18% stake in Universal Sampo. General insurance Co. LTD which is a non-life insurance business.

Fundamental Analysis of Indian Overseas Bank

- Market Capital -₹1,02,848Cr

- Current Price – ₹54.4

- 52 weeks low / high – ₹83.8/36.6

- P/E – 36.83

- P/B – 4.15

- ROCE –41%

- ROE –98%

- Promoter Holding – 96.4%

- Sales growth – 23.4%

- Profit growth – 26.3%

- CASA – 43.90%

- CAR – 17.28%

- Book Value – ₹13.08

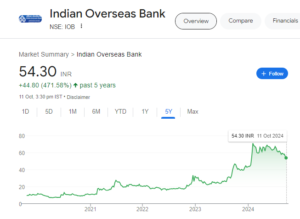

The price chart of Indian Overseas Bank (IOB) share

The Indian Overseas Bank share price target up to 2035

Noticing the recent performance of the company, the giants of the market expects that this really may be seen for next 10 years. The experts has expected that the price of the share may reach₹121 – ₹155 for the year of 2030 and ₹251 – ₹307 for the year of 2035.

Indian Overseas Bank share price target -2025

According to market analysis, it is expected that the IOB’s minimum share price may reach ₹61 and ₹75 maximum price in the year of 2025.

| Year

|

Target Price (min) | Target Price(max) |

| 2025

|

₹61 | ₹75 |

Read more : Reliance industries limited share price target forecast – 2025, 2026, 2027, 2028, 2029 & 2030

Indian Overseas Bank share price target -2026

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹70 and maximum price ₹85 in the year of 2026.

| Year

|

Target Price (min) | Target Price(max) |

| 2026

|

₹70 | ₹85 |

Read More: Lloyds Enterprises Ltd target share price forecast – 2025, 2026, 2027, 2028, 2029, 2030

Indian Overseas Bank share price target -2027

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹81 and maximum price ₹110 in the year of 2027.

| Year

|

Target Price (min) | Target Price(max) |

| 2027

|

₹81 | ₹110 |

Read more : IRFC share target price 2025,2026,2027,2028,2029,2030

Indian Overseas Bank Share price target -2028

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹89 and maximum price ₹131 in the year of 2028.

| Year

|

Target Price (min) | Target Price(max) |

| 2028

|

₹89 | ₹131 |

.

Read More :Rama Steel Pipes Ltd Share Price Target 2025 to 2035 –In Depth-analysis

Indian Overseas Bank share price target -2029

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹105 and maximum price ₹145 in the year of 2029.

| Year

|

Target Price (min) | Target Price(max) |

| 2029

|

₹105 | ₹145 |

Read More : Vedanta industries Ltd share price target 2025,2026,2027,2028,2029,2030

Indian Overseas Bank share price target -2030

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹121 and maximum price ₹155 in the year of 2030.

| Year

|

Target Price (min) | Target Price(max) |

| 2030

|

₹121 | ₹155 |

Read more: Shree Renuka Sugars Ltd share price target 2025,2026,2027,2028,2029,2030 to 2035

Indian Overseas Bank share price target -2031

According to market analysis, it is expected that the IOB’s minimum share price may reach ₹141 and maximum price ₹173 in the year of 2031.

| Year

|

Target Price (min) | Target Price(max) |

| 2031

|

₹141 | ₹173 |

Read More : IREDA share price 2025, 2026, 2027, 2028, 2029, 2030

Indian Overseas Bank share price target -2032

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹175 and maximum price ₹203 in the year of 2032.

| Year

|

Target Price (min) | Target Price(max) |

| 2032

|

₹175 | ₹203 |

Read More: Sarda Energy & minerals Ltd share price target 2025,2026,2027,2028,2029,2030 to 2035

Indian Overseas Bank share price target -2033

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹185 and maximum price ₹233 in the year of 2033.

| Year

|

Target Price (min) | Target Price(max) |

| 2033

|

₹185 | ₹233 |

Read more : Tata Gold ETF share price target 2025 to 2035

Indian Overseas Bank share price target -2034

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹217 and maximum price ₹265 in the year of 2034.

| Year

|

Target Price (min) | Target Price(max) |

| 2034

|

₹217 | ₹265 |

Read More: UCO Bank share price target 2025,2026,2027,2028,2029,2030

Indian Overseas Bank share price target -2035

According to market analysis, It is expected that the IOB’s minimum share price may reach ₹251 and maximum price ₹307 in the year of 2035.

| Year

|

Target Price (min) | Target Price(max) |

| 2035

|

₹251 | ₹307 |

Read More: Heritage Foods share price target 2025, 2026, 2026, 2027, 2028, 2029, 2030

The peers companies of Indian Overseas Bank

- State Bank of India

- Bank of Baroda

- Punjab National Bank

- Canara Bank

- Union Bank

- Indian Bank

Read More : Waaree Energies share price target 2025, 2026, 2027, 2028, 2029, 2030

The share pattern of Indian Overseas Bank share

- Promoters – 73.91%

- FIIs – 0.24%

- DIIs – 0.00%

- Public – 25.84

The key factors of Indian Overseas Bank share

- The bank has introduced latest different type of loan schemes named “Personal Loan Top up scheme” and “Capital Light Asset Product” in FY24. The First type provides personal loan borrowers a maximum loan of Rs7.50 Lakh and the second type provides load against Sovereign Gold Bond”.

- The Gross Non Performing Asset (NPA) of the bank has reduced to 2.89 in FY2024 from 9.82% in FY22 and Net Non Performing Asset(NPA) is 0.51% in FY2024 from 2.65% in FY22.

- The bank has launched new digital initiatives such as “Tab Banking” , “Instant Safe Deposit Locker Allotment”, “My Account My Name” through a web based portal, etc as of recent data.

- In 2024, The bank has a base of 41mn active customers from which 31.25 lakhs internet banking registered users and 85.7 lakhs mobile banking users.

- In FY2025, the bank has expected that they will have shown a good credit growth of 13% to 14% and the deposit growth has expected to be 11% to 12%.

The Pros and Cons of Indian Overseas Bank

The Pros

- The bank has shown efficient profit growth of 47.27 over the last 3 years.

- The bank has shown Good Capital Adequacy Ratio of 17.28%.

- The CASA of IOB is 43.90% of total deposits.

- The CAGR of the bank is 23%.

The Cons

- The ROE of the bank is 9.98%.

- The bank is trading 4.50 times od its Book Value.

- The bank has low Interest Coverage Ration.

- The bank has contingent liabilities of Rs2,14,760Cr.

- The bank has shown a poor sales growth of 6.41% over last 5 years.

Should you invest in Indian Overseas Bank?

You can invest in Indian Overseas Bank share if you will go with long term investment for 5 to 10 years.

Conclusion:

I hope you have already make out all facts of Indian Overseas Bank share. and make a basic idea about Indian Overseas Bank share price target which may help you investing in Shree Indian Overseas Bank share. But It is fact that the share market is always unpredictable. Nobody can read it properly. It is just a roadmap and write for only information and education purpose, not recommendation. You should analysis yourself or take advice from any financial experts before investing.

*Disclaimer* :

The information provided on hsm_fin_advisor is for general informational purposes only and should not be considered financial advice or recommendation. While I strive to provide accurate and up-to-date content, I cannot guarantee the completeness or reliability of the information presented. Financial decisions are personal and can vary significantly based on individual circumstances.

Always consult with a qualified financial advisor or conduct thorough research before making any financial decisions. The views expressed on this blog are solely my own and do not reflect the opinions of any organizations or individuals I may be affiliated with.

By using this site, you agree that I am not liable for any losses or damages resulting from your reliance on any information provided here.