Waaree Energies share price target 2025, 2026, 2027, 2028, 2029, 2030

Waaree Energies Ltd is one of leading players in the renewable energy sector in India. The company is engaged in manufacturing, developing and operating the solar energy. Today we will discuss Waaree Energies share price target 2025, 2026, 2027, 2028, 2029 and 2030. We did valuable research and took important advice from market giants to write the financial blog.

Overview of Waaree Renewables Technologies Ltd

- Waaree Energies Ltd was established in 1992. Its headquarters is situated in Mumbai. The founder of the company is Hitesh Doshi. The company was listed in Indian Stock Market in October24, 2024.

- Waaree Energies Ltd is a leading Indian solar module manufacturer with a 12 GW module capacity. The company has manufactured high qualities solar power-related products like solar panels, solar water pump & streetlight, lithium-lon Batteries, inverters etc. The company also provides EPS Services.

- The company has expanded its business in both domestic and international market. The products of the company have been exported over 68 countries worldwide.

Waaree Energies Ltd share IPO details

- Date: October 21 to October 23,2024

- Issue Price: the price range was set at ₹1427 – ₹1503 per share

- Subscription: The IPO saw a remarkable subscription rate of 76.34 times with institutional investors subscribing 208.63 times.

- Listing Price: share listed at ₹ 2,550 on the BSE and ₹ 2,500 on NSE, both significantly higher than the issue price .

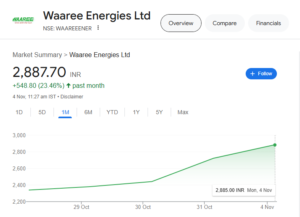

The Price Chart of Waaree Energies Ltd

Waaree Energies share price Target 2025 to 2030

Recently, Waaree Energies Ltd Has launched a successful IPO. The company’s Share jumped 70% from the issue price on its listing day. The company’s healthy finances, futuristic business structure, and recent growth have increased public interest in investing. So, the market experts expect that such a trend will continue for the upcoming years. The price targets of the share is given in below.

Waaree Energies share price Target 2025

As per market experts, it is expected that the minimum share price of Waaree Energies may reach ₹3418 and a maximum price ₹3974 in the year 2025.

| Year | Target Price

(min) |

Target Price

(max) |

| 2025 | ₹ 3418 | ₹3974 |

Read More: UCO Bank share price target 2025,2026,2027,2028,2029,2030

Waaree Energies share price Target 2026

As per market experts, it is expected that the minimum share price of Waaree Energies may reach ₹ 4258 and a maximum price ₹4971 in the year 2026.

| Year | Target Price

(min) |

Target Price

(max) |

| 2026 | ₹ 4258 |

₹4971

|

Read More: Indian Overseas Bank share price target 2025,2026,2027,2028,2029,2030 to 2035

Waaree Energies share price Target 2027

As per market experts, it is expected that the minimum share price of Waaree Energies may reach ₹ 5011 and a maximum price ₹5978 in the year 2027.

| Year | Target Price

(min) |

Target Price

(max) |

| 2027 | ₹ 5011 | ₹5978 |

Read more : IRFC share target price 2025,2026,2027,2028,2029,2030

Waaree Energies share price Target 2028

As per market experts, it is expected that the minimum share price of Waaree Energies may reach ₹ 5874 and a maximum price ₹6781 in the year 2028.

| Year | Target Price

(min) |

Target Price

(max) |

| 2028 | ₹5874 | ₹6781 |

Read More: Lloyds Enterprises Ltd target share price forecast – 2025, 2026, 2027, 2028, 2029, 2030

Waaree Energies share price Target 2029

As per market experts, it is expected that the minimum share price of Waaree Energies may reach ₹6878 and a maximum price ₹8015 in the year 2029.

| Year | Target Price

(min) |

Target Price

(max) |

| 2029 | ₹6878 | ₹8015 |

Read more : Reliance industries limited share price target forecast – 2025, 2026, 2027, 2028, 2029 & 2030

Waaree Energies share price Target 2030

As per market experts, it is expected that the minimum share price of Waaree Energies may reach ₹ 7849 and a maximum price ₹9547 in the year 2030.

| Year | Target Price

(min) |

Target Price

(max) |

| 2030 | ₹7849 | ₹9547 |

Read More : IREDA share price 2025, 2026, 2027, 2028, 2029, 2030

The Fundamentals of Waaree Energies Ltd

- Market Capital : ₹83,028Cr.

- Current Price : ₹ 2,890

- 52 weeks High/Low : ₹2,910/2,295

- Entreprise value: ₹79,755Cr.

- P/E : 84.0

- P/B : 9.93

- EPS: ₹62.8

- ROCE: 43.6%

- ROE: 33.4%

- Cash : ₹3,615.99Cr.

- Book Value : 291.57

- Debt: ₹513Cr.

- Sales Growth : 64.06%

- Profit Growth : 149.54%

- Promoter Holding: 64.3%

The shareholding pattern of Waaree Energies Ltd

- Promoter – 64.3%

- FII – 2.23%

- DII – 2.8%

- Public – 30.67%

The peers companies of Waaree Energies Ltd

- Siemens (Market cap : ₹2,47,471.70Cr.)

- ABB India (Market cap : ₹1,57,456.40Cr)

- CG power & Ind (Market cap : ₹110142.85Cr)

- Havells India (Market cap : ₹1,03,320.00Cr)

- Suzlon Energy (Market cap : ₹93,056.64Cr)

- Hitechi Energy India (Market cap : ₹58,736.55Cr)

- Apar Inds (Market cap : ₹40,096.01Cr)

- Inox Wind (Market cap : ₹28,898.59Cr)

The key factors of Waaree Energies Ltd

-

Increasing Demand of Renewable Energy :

The demand for renewable energy is increasing due to limited natural resources. In this case, solar energy-related companies will play a vital role. Being a leading company in this sector, Waaree Energies has a big advantage in this trend. The more the company generates revenue, the more the public will invest in the share.

-

The Support of Government :

Indian Government has shown interest in boosting solar power and supported the companies by giving subsidies, and tax incentives. It provides a suitable atmosphere for Waaree Energies by which the company can expand its business rapidly.

-

Efficient Production Capacity :

On account of meeting high demand both domestically and globally, Waaree Energies has invested a huge amount to boost its production capacity. In this way, the company will capture a huge market and increase sales of its products.

-

Diversify Marketing :

To notice enhancing the demand for solar energy in the global market, Waaree Energies is exporting its products to the global market. By making a brand in the international market, the company can diversify its revenue streams and cut down the risks in the domestic market. This step can provide steady growth in the company’s share.

-

Innovative products :

The company always keeps watch to update its technologies and innovate advanced products. It helps the company fulfil the demands of customers from time to time and the company has shown stable growth in its financial statement which can attract the public to invest.

- Strong Patnership with Corporate World :

Waaree Energies always has a strategy to make partnership with corporate clients who want to shift towards renewal energy. Besides generating the company’s revenue, The strategy plays a vital role in gaining reputation as a reliable suppliers. It gives a strong positivity to the company’s growth over time.

-

Awarness of Nature :

With increasing awareness of nature and limited natural resources, the whole world has shifted to renewable energy from fossil fuels like coal, natural gases etc. In the near future, renewable energy will become the main source in the energy sector. In this case, Waaree energies play an important role in fulfilling this demand.

The potential risks of Waaree Energies Ltd

-

Changing Government Policies :

The Government’s support like subsidies and low taxes incentives helps to grow solar companies like Waaree Energies Ltd. But any changes in Government policies in the near future will have badly impacted the company’s growth.

- Compitive Market :

Waaree Energies has faced great competition against other market leader companies in the solar industry. If the management fails to manage it, it directly affects on company’s profit and share price.

-

High Cost of Raw materials :

To produce solar panels, specific raw materials like silicon, Glass Encapsulant, Aluminum, Backsheet are essential for Waaree Energies. The high price of raw materials negatively impacts the company’s profit margin which cuts down the company’s share price indirectly.

-

Unpredictable Global Market:

Besides India, The company is expanding its business in many foreign markets. The unfavourable situations in those countries like war, influence, and trade restrictions can prevent its growth and impact its share price.

-

The Strict Regulation of Government :

The company must obey the regulations of the government on the environment. If any activities of the company break the regulations, the company will have to pay a huge plenty and lose its reputation.

Conclusion:

I hope you have already made out all facts of Waaree Energies Ltd share. And make a basic idea about Waaree Energies Ltd’s share price target which may help you invest in Waaree Energies Ltd share. But It is a fact that the share market is always unpredictable. Nobody can read it properly. It is just a roadmap and is written for only information and education purposes, not recommendations. You should analyse yourself or take advice from any financial experts before investing.

*Disclaimer* :

The information provided on hsm_fin_advisor is for general informational purposes only and should not be considered financial advice or recommendation. While I strive to provide accurate and up-to-date content, I cannot guarantee the completeness or reliability of the information presented. Financial decisions are personal and can vary significantly based on individual circumstances.

Always consult with a qualified financial advisor or conduct thorough research before making any financial decisions. The views expressed on this blog are solely my own and do not reflect the opinions of any organizations or individuals I may be affiliated with.

By using this site, you agree that I am not liable for any losses or damages resulting from your reliance on any information provided here.